The Asset Liability Management (ALM) study is the logical complement to an actuarial forecast of premiums, benefits and actuarial reserves. Only by reflecting liabilities (the liabilities side of the balance sheet) with possible investment developments (the assets side of the balance sheet) is it possible to present a full picture of the possibilities for meeting obligations in the long term, even in a challenging environment, as for example low interest rates, stress scenarios on capital markets. In addition to information on the optimal restructuring of the allocation to meet the actuarial interest rate, an ALM study can show whether the financing system in its current form is sustainable and sufficient risk carriers are available or whether a modification of the system is advisable.

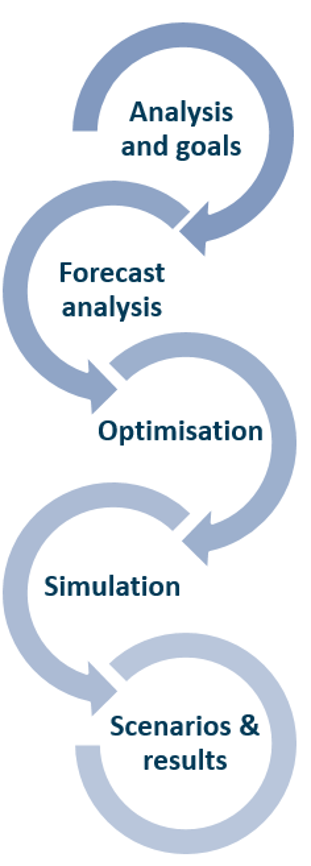

Agreement on net interest requirements and actuarial interest, reserve policy, use of available risk carriers, risk tolerance, etc. Coordination of the management rules for the balance sheet appropriation of the accrued profit from the capital investment.

Coordinating with the actuary the alternative scenarios to be calculated (e.g. discussion of useful modifications of the parameters), checking the calculations for completeness and plausibility, summarising the findings. If necessary, consulting the actuary about the results.

Inventory of the actual allocation and calculations regarding strategic asset classes. Evaluation of return and risk expectations using the FERI long-term forecast (long-term return and risk assumptions). Optimisation of the allocation under the applicable restrictions. The aim is to meet the yield requirements and to demonstrate a high degree of confidence in maintaining risk-bearing capacity.

Generation of 10,000 forecast paths for yield development of individual asset classes, taking into account skewed distributions of returns, interest rate jumps, etc. Consideration of alternative interest rate scenarios according to agreement. Simulation of the portfolios presented into the future with simultaneous calculation of the resulting changes in the balance sheet ratios (coverage ratio, equity, net interest rate, etc.).

Evaluation of the simulation results (mean values, fluctuation ranges) with comparison of the scenarios. Presentation according to the client’s focus of interest (e.g. use of risk carriers and balance sheet ratios). Identification of portfolios with the most favourable degree of target achievement. Outlining of recommendations for future strategic asset allocation (SAA) and measures relating to the liabilities and/or accounting policy where required.

T +49 (0) 6172 916-3625

F +49 (0) 6172 916-9000

marcus.burkert@feri.de

Rathausplatz 8-10

D-61348

Bad Homburg

Haus am Park